The Truth About Stock Market Income: My Personal Story

The Truth About Stock Market Income: My Personal Story

Curious about earning income from the stock market? I share my personal journey, how I pay bills and groceries from my trading account every month, and the strategies I use to grow consistently.

Table of Contents

When I first started trading, I never imagined that one day I could pay my bills entirely from the stock market. I used to think trading was just for big investors or people with years of experience. But over time, I developed a system that allowed me to treat my trading account like a personal paycheck.

In this post, I’m going to share exactly how I do it, the tools I use, and the mindset that helps me manage risk while growing my account. I’ll also point you to my eBook, Pay Bills With Stocks, where I break down the process step by step.

How I Treat My Stock Account Like a Job

One of the biggest mindset shifts I made was thinking of my stock account as my monthly income. Every month, I plan exactly how much I’ll withdraw to pay bills, groceries, and essentials.

Here’s the simple system I use:

- I track my portfolio growth weekly

- I determine a safe percentage to withdraw for monthly expenses

- I reinvest the rest to continue growing my account

For example, if my portfolio grows by 5% in a month, I might take 2% out for bills and let the remaining 3% stay invested. This way, I balance income and growth without putting my account at risk.

My Monthly Stock Income Plan

Unlike a traditional job where you get a fixed paycheck, I treat stock market income strategically:

- Step 1: Check account growth and available cash

- Step 2: Calculate a percentage that covers bills without harming long-term growth

- Step 3: Withdraw funds and pay essentials like rent, utilities, and groceries

- Step 4: Reinvest the rest into high-potential stocks or ETFs

This plan gives me financial stability and peace of mind, knowing that my account continues to grow while still covering my living expenses.

Why My System Works

The key to my success is consistency and risk management. I never withdraw too much at once, and I never chase hype stocks. Instead, I focus on steady growth, tracking my investments with TradingView, and only taking calculated risks.

I also use beginner-friendly trading platforms like:

- Robinhood → For easy access to stocks and fractional shares

- Webull → For more advanced charts, analysis, and paper trading

The Role of My eBook

To make this system easier for others, I wrote my eBook: Pay Bills With Stocks. In it, I explain:

- How I set up my stock account to generate monthly income

- My exact strategy for withdrawing a safe percentage each month

- How to reinvest to grow your account while covering expenses

This eBook is like having a roadmap for turning a stock account into a steady, reliable source of income, even if you’re a beginner.

Treating Stock Trading Like a Job

The biggest difference between casual traders and those who make consistent income is discipline. I schedule time every day to:

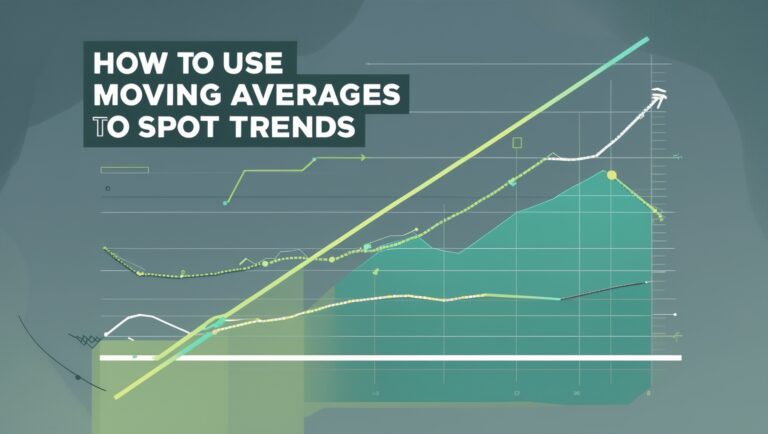

- Check charts and trends on TradingView

- Review my portfolio performance

- Make calculated trades based on research and analysis

Treating it like a job ensures I’m not reacting emotionally and that my income remains predictable.

How I Decide What Percentage to Withdraw

Every month, I calculate a safe withdrawal percentage based on:

- Portfolio performance

- Upcoming expenses

- Market conditions

For me, this usually ranges from 2–5% of my portfolio. By sticking to this plan, I cover bills without depleting my long-term growth potential.

Balancing Income and Growth

The beauty of this system is that it’s self-sustaining. The money I withdraw covers essentials, while the rest of my portfolio continues to compound over time.

It’s similar to having a job where part of your salary is reinvested to increase your future earning potential. This balance is what makes stock trading a viable monthly income source.

My Advice to Beginners

If you’re just starting, here’s what I recommend:

- Begin with a small account, even $100–$200

- Track growth and withdraw only a safe percentage

- Focus on learning and consistency rather than chasing quick wins

- Use tools like TradingView to analyze your stocks

- Start with beginner-friendly platforms like Robinhood or Webull

By following these steps, you can turn your stock account into a reliable income source over time.

My Monthly Routine

Here’s a peek at how I manage my account every month:

- Week 1: Review last month’s performance, plan withdrawals

- Week 2: Analyze stocks and potential trades

- Week 3: Execute trades based on strategy and research

- Week 4: Track performance, set alerts, and adjust the plan for the next month

This routine keeps me organized, consistent, and profitable.

Why This Approach Feels Like a Real Job

Unlike speculative trading, this system provides predictable income and financial stability. I know exactly how much I can withdraw each month, just like a paycheck, and I always have a plan to grow my portfolio for the future.

It’s not magic—it’s strategy, discipline, and consistency.

Final Thoughts

Stock trading doesn’t have to be a gamble. With a plan, discipline, and the right tools, you can treat your portfolio like a job, pay your bills, and still grow your wealth.

If you want to learn the exact step-by-step system I use every month, check out my eBook 👉 Pay Bills With Stocks. It’s everything I wish I knew when I started trading.

One of the biggest lessons I learned early on is that consistency beats big wins. It’s tempting to chase a huge stock gain, but the real magic happens when you make small, steady profits every month.

I also realized that having a plan for my withdrawals is essential. Without a plan, it’s easy to spend too much and slow down portfolio growth. By treating my account like a paycheck, I create a balance between income and long-term wealth.

Tracking my expenses alongside my portfolio growth gives me peace of mind. I know exactly how much I can safely withdraw for bills, groceries, and essentials without risking my future growth.

Every month, I set a goal for how much of my portfolio growth I’ll reinvest. This habit ensures that my account continues to grow, even while I’m taking a portion out to cover living expenses.

I also learned the value of using multiple platforms. TradingView helps me analyze charts and spot opportunities, while Robinhood and Webull allow me to execute trades and manage my withdrawals efficiently.

Keeping a trading journal has been a game-changer. I write down every trade, the reasoning behind it, and the outcome. Over time, this log has become an invaluable tool for improving my strategy and making better decisions.

Risk management is at the core of my approach. I never risk more than a small percentage of my account on a single trade. Even when I withdraw for bills, the remaining balance continues to grow safely.

Paper trading helped me build confidence. I practiced my strategy in a simulated environment before committing real money. This step allowed me to make mistakes and learn from them without losing anything.

I treat every month like a business cycle. I review performance, plan withdrawals, analyze new opportunities, and set actionable goals for the next month. This routine has made trading feel structured and professional.

My eBook, Pay Bills With Stocks, dives deeper into the exact percentages I use for withdrawals and growth. It’s like having a blueprint for a trading-based income system.

Even small accounts can grow with discipline. You don’t need thousands of dollars to start—what matters is learning, planning, and consistently applying your strategy.

I also learned the importance of separating income from growth. The portion I withdraw for bills is untouchable for investing, and the portion I leave in the account continues to compound over time.

Watching my portfolio grow while still having a reliable monthly income is empowering. It’s proof that the stock market can work like a paycheck if you treat it seriously and strategically.

Sometimes, friends ask me if trading feels stressful. Surprisingly, it doesn’t—because I have a plan, I know my limits, and I only risk what I can afford. This approach turns uncertainty into control.

Finally, I remind myself every month that this system is sustainable. By treating stock trading like a job, I’ve created a reliable income stream, financial independence, and the freedom to make smart long-term decisions.

Stay ahead in the stock market! Subscribe to our newsletter and receive exclusive stock flow reports, trading insights, and actionable tips directly in your inbox. Join thousands of traders who get our updates first.