Chart Patterns Every Beginner Should Know Before Making a Trade

Chart Patterns Every Beginner Should Know Before Making a Trade

Learning to recognize chart patterns is one of the easiest ways to improve your trading as a beginner. I remember feeling lost when I first started, unsure which patterns mattered. In this guide, I’ll show the chart patterns every beginner should know before making a trade, along with the tools I use to trade confidently and pay my bills monthly with stocks.

Table of Contents

Why Chart Patterns Are Important

Chart patterns help traders predict potential price movements and identify opportunities before others notice them. Recognizing patterns allows you to make informed decisions and avoid unnecessary losses.

When I first started, I ignored chart patterns and relied on intuition. That quickly led to losses. Learning a few key patterns changed my trading strategy entirely.

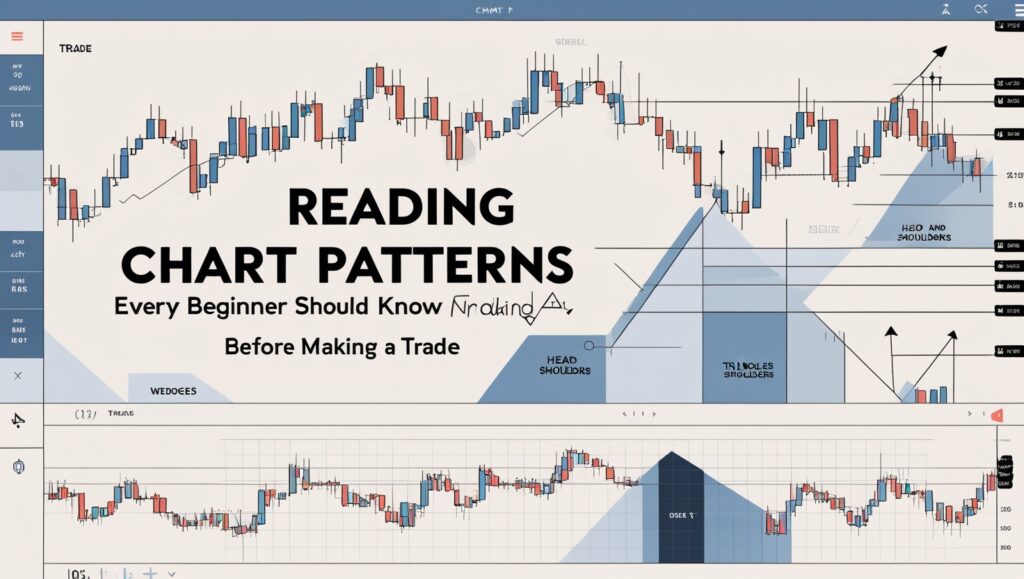

The Head and Shoulders Pattern

The head and shoulders pattern is a reliable indicator of trend reversals.

- Head: The highest peak

- Shoulders: Lower peaks on each side

When the price breaks the neckline, it often signals a reversal, allowing me to enter or exit trades with confidence.

Double Tops and Double Bottoms

These patterns signal strong support or resistance levels:

- Double top: Indicates a potential sell signal

- Double bottom: Indicates a potential buy signal

Recognizing these patterns early helps me make trades with a higher probability of success.

Triangles: Ascending, Descending, and Symmetrical

Triangles show consolidation and potential breakout points:

- Ascending triangle: Often signals a bullish breakout

- Descending triangle: Often signals a bearish breakout

- Symmetrical triangle: Signals continuation or breakout in either direction

Using triangles has helped me anticipate trends and plan trades before the price moves significantly.

Flags and Pennants

Flags and pennants are short-term patterns that indicate momentum continuation.

- Flags: Small rectangular patterns after a strong move

- Pennants: Small symmetrical patterns after a strong move

These patterns helped me spot quick entry points and ride momentum effectively.

Cup and Handle Pattern

The cup and handle is a bullish continuation pattern that indicates potential upward price movement.

I use this pattern to identify long-term buying opportunities and avoid entering trades too early.

How to Apply Chart Patterns Effectively

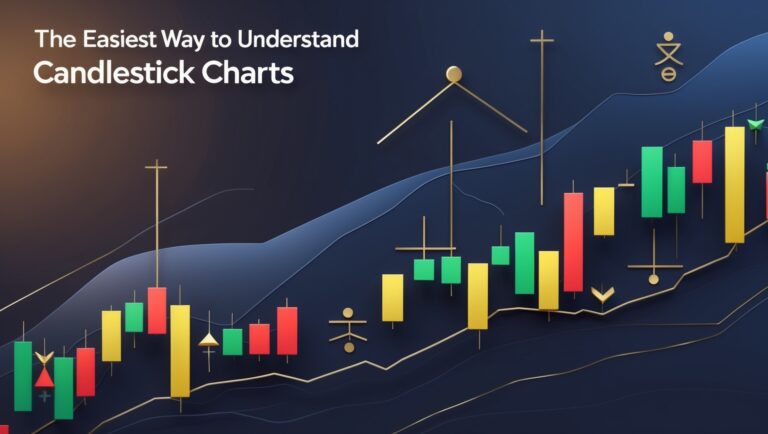

Recognizing chart patterns is only the first step. I pair patterns with indicators like moving averages, RSI, and MACD to confirm potential buy or sell signals.

Using TradingView, I can customize charts, apply indicators, and quickly spot patterns across multiple stocks.

Combine Patterns With a Proven System

Even the best chart patterns are more effective when combined with a structured system. My ebook, How I Pay My Bills Monthly With Stocks, shows exactly how I use patterns and indicators to generate consistent monthly income.

Conclusion: Start Using Chart Patterns Today

Learning these chart patterns doesn’t have to be complicated. Start by focusing on the head and shoulders, double tops and bottoms, triangles, flags, pennants, and cup and handle patterns, then combine them with simple indicators to trade confidently.

Start today:

- Sign up for TradingView to spot patterns and confirm signals: https://www.tradingview.com/?aff_id=155687

- Learn my full system for turning chart patterns into monthly income: https://stockflowreport.gumroad.com/l/paybillswithstocks

With the right tools and approach, recognizing chart patterns becomes simple, actionable, and profitable—even for beginners.

When I first started trading, charts looked like a confusing mess. I didn’t know where to start, which is why learning a few key chart patterns made a huge difference.

The head and shoulders pattern became my first favorite. Even spending a few minutes identifying the head and shoulders on a chart gave me confidence in predicting potential reversals.

Double tops and double bottoms are simple but powerful. They help me see where price may reverse and avoid entering trades at the wrong time.

Triangles are patterns I check daily. Whether ascending, descending, or symmetrical, they help me anticipate breakouts and plan my trades more effectively.

Flags and pennants have been great for spotting short-term momentum. I use these patterns to catch quick moves without getting overwhelmed by complex setups.

The cup and handle pattern has helped me identify longer-term bullish opportunities. Waiting for the handle formation prevents me from entering too early and reduces risk.

I always combine patterns with basic indicators like moving averages, RSI, and MACD. This combination confirms signals and helps me trade with more confidence.

Using TradingView makes spotting patterns easy. I can customize charts, save templates, and set alerts, which saves time and reduces mistakes.

Daily practice is key. Even 10–15 minutes scanning charts for patterns improves my ability to recognize setups and make quicker, better trading decisions.

Keeping a trade journal where I log patterns, entries, and outcomes has been invaluable. I can review past trades, learn from mistakes, and refine my strategy over time.

Combining these patterns with a structured system, like the one in my ebook How I Pay My Bills Monthly With Stocks, allows me to turn pattern recognition into consistent results.

Finally, simplicity is essential. By focusing on a few key chart patterns and confirming them with simple indicators, even beginners can trade confidently without feeling overwhelmed.

One thing I learned quickly is that context matters. Chart patterns are most reliable when combined with market trends and volume analysis. For example, a breakout from a triangle pattern with high volume is far more likely to succeed than one with low volume.

I also focus on timeframes. Some patterns appear on daily charts, while others are clearer on weekly or hourly charts. Understanding which timeframe to analyze helps me spot high-probability setups without confusion.

Lastly, patience is key. Not every pattern results in an immediate trade. I wait for confirmation from indicators or price action before entering, which has significantly improved my trading success and reduced stress.

How I Pay My Bills Monthly With Stocks

Stay ahead in the stock market! Subscribe to our newsletter and receive exclusive stock flow reports, trading insights, and actionable tips directly in your inbox. Join thousands of traders who get our updates first.